Legal Update

Jun 10, 2013

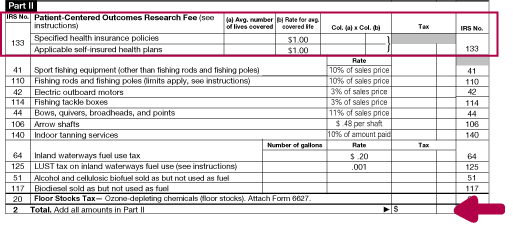

Issue 66: IRS Releases Form Used to Pay PCORI Fee

This is the sixty-sixth issue in our series of alerts for employers on selected topics on health care reform. (Click here to access our general Summary of Health Care Reform and other issues in this series.) This series of Health Care Reform Management Alerts is designed to provide an in-depth analysis of certain aspects of health care reform and how it will impact your employer-sponsored plans.

As we stated in Issues 39 and 47, starting with plan years ending on or after October 1, 2012, the Affordable Care Act (ACA) imposes a fee on all insurers and sponsors of self-funded group health plans which is intended to pay for research conducted by the Patient Centered Outcomes Research Institute (PCORI) comparing the clinical effectiveness of various medical treatments. The fee is paid using IRS Form 720.

Where can I find the form used to pay the fee?

The IRS recently amended Form 720 and accompanying instructions, which are available here:

http://www.irs.gov/pub/irs-pdf/f720.pdf

http://www.irs.gov/pub/irs-pdf/i720.pdf

When is the PCORI fee due?

The PCORI fee is due no later than July 31 of the calendar year following the close of the plan year, as indicated below:

| Plan Year End Date | Fee Due Date (first year) |

| October 1, 2012 - December 31, 2012 | July 31, 2013 |

| January 1, 2013 - September 30, 2013 | July 31, 2014 |

How much is the fee?

For the first year of applicability, the fee is $1 per covered life (meaning employees and covered dependents). The fee increases to $2 per covered life in the next year. For later years (through the 2018 plan year), the fee increases based on the increase in national health expenditures. (For more information about determining covered lives, see Issue 47.)

How do I complete the Form 720?

1. Complete the general information at the top of page 1

2. The PCORI fee is reported on page 2 of the Form, under Part II. Sponsors should report the number of covered lives in column a, and multiply by the rate in column b ($1 this year). Then, fill in the total at the bottom of Part II.

3. Sign and date the form at the bottom of page 2.

4. Send the form to:

Department of the Treasury

Internal Revenue Service

Cincinnati, OH 45999-0009