Among many key topics covered in Seyfarth’s 9th annual Real Estate Market Sentiment Survey, CRE executives weigh in on their top concerns, investment priorities, and key catalysts for change. Read on for key highlights, or download the full survey now.

Promising Possibilities

After a challenging 2023, 83 percent of CRE executives surveyed have a buoyant outlook for the sector in 2024. This prevailing optimism is underpinned by various factors, including anticipated interest rate reductions by the Federal Reserve, indications of a deceleration in inflationary pressures, promising trends in GDP growth and employment figures, the prospect of investing in distressed assets, and the impending national election.

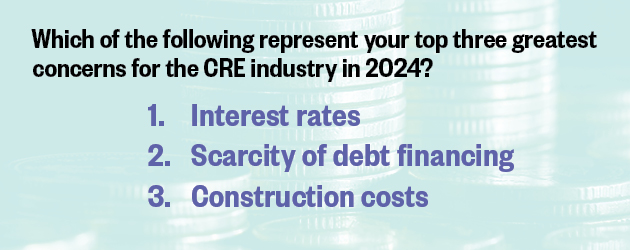

Cardinal Concerns

Apprehension over interest rates topped the list of concerns as expected, followed by scarcity of debt financing. Notably, it was surprising to not see greater uneasiness over inflation. Although there is a dramatic decrease in the number of respondents worried about a recession when compared to 2023, the fact that more than a third of CRE executives still believe that economic recession is a top three concern for the industry demonstrates that many do not believe we have safely executed a soft landing for the economy.

AI

Ambivalence

Respondents were split down the middle when it came to whether or not artificial intelligence would play a role in their investment activity and operations in 2024. Given generative AI’s recent surge in popularity, despite 50 percent of respondents still being on the fence, it seems that a growing segment of the industry is embracing this ever-evolving technology and will continue to do so.

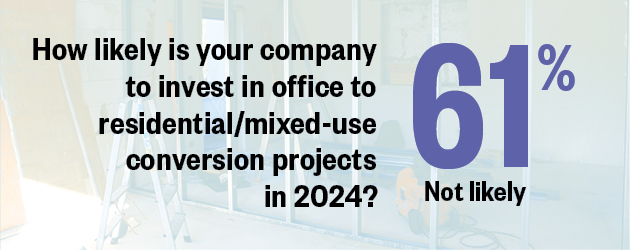

Tentative Trend

Despite headlines touting office to residential or mixed-use conversions as a panacea for stagnating central business districts, market participants remain hesitant, with 61 percent indicating that they are not likely to invest in conversion projects in 2024. Nevertheless, 10 percent of respondents are likely or very likely to invest in these projects, and the rest have some interest. Given growing investor interest, incentives provided by various levels of government, and the housing crisis, this is likely to be an area worthy of continued attention.

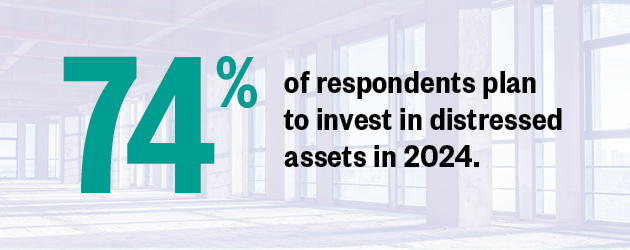

Dabbling in Distress

74 percent of respondents plan to invest in distressed assets in 2024, with an allocation of between 11-25 percent being the most popular category, followed closely by an allocation of up to 10 percent. While 26 percent of respondents will not allocate any investment to distressed assets, a minority of 9 percent plan to invest more than half of their portfolios.

Past Surveys

2024 marks the 9th year of our Real Estate Market Sentiment Survey. Download past surveys via the links below.