Legal Update

Feb 25, 2013

Issue 52: More FAQs -- Guidance on Cost-Sharing and Preventive Care

This is the fifty-second issue in our health care reform series of alerts for employers on selected topics in health care reform. (Our general summary of health care reform and other issues in this series can be accessed by clicking here). This series of Health Care Reform Management Alerts is designed to provide a more in-depth analysis of certain aspects of health care reform and how it will impact your employer-sponsored plans.

We have seen the IRS, DOL and HHS (the “Agencies”) jointly issue several FAQs providing additional guidance on various provisions of the Affordable Care Act (ACA). Several more were released last week on the ACA’s restrictions on cost-sharing limitations and the requirement to provide 100% coverage for preventive care. This Alert supplements our prior Issues 10, 25 and 46 on these topics.

Cost-Sharing Limitations

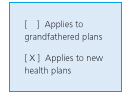

The FAQs were issued simultaneously with the final regulations on essential health benefits issued by HHS (discussed in upcoming Issue 53). The preamble to those regulations states that the limit on deductibles for non-grandfathered health plans only applies to plans and issuers in the small group market. The Agencies confirm that position in the FAQs and state that they will take public input on this point before finalizing that position. Until then, self-insured and large group health plans can rely on the Agencies current position that they do not have to comply with the limits on deductibles.

In contrast, the Agencies believe that all non-grandfathered group health plans must comply with the ACA’s limits on out-of-pocket maximums. The Agencies acknowledge that a group health plan may have multiple service providers (e .g., for major medical, prescription drug and behavioral health) making coordination of a single maximum across the plan difficult. As a result, they are providing transitional relief for the 2014 plan year. Under this relief, group health plans will be deemed to have met the out-of-pocket limitation if:

.g., for major medical, prescription drug and behavioral health) making coordination of a single maximum across the plan difficult. As a result, they are providing transitional relief for the 2014 plan year. Under this relief, group health plans will be deemed to have met the out-of-pocket limitation if:

- the plan complies with the out-of-pocket limits with respect to its major medical component; and

- any other component of the plan has its own out-of-pocket limits and methodology, such out-of-pocket maximum does not exceed the limits in place for high deductible health plans.

The Agencies warn plans not to forget that they must also comply with the Mental Health Parity and Addiction Equity Act of 2008, which forbids plans from imposing separate limitations (including out-of-pocket maximums) on benefits for mental health or substance abuse treatments.

Preventive Services

Recall that the ACA requires non-grandfathered group health plans to cover preventive services at 100%. The FAQs provide further interpretation of questions that have arisen under the Interim Final Regulations (IFRs).

The IFRs provided that where a plan has in-network and out-of-network coverage, the rules are satisfied where the preventive services are covered without cost-sharing under the in-network portion of the plan. The FAQs address the situation where a particular preventive service is not available from an in-network provider but is available from an out-of-network provider. While this may rarely occur for a recognized preventive service, in such a case, the preventive service rendered by the out-of-network provider must be covered at 100%. The FAQ does not elaborate on whether the coverage must be at 100% of the amount charged, or may be limited to 100% of the usual, customary and reasonable amount.

Other preventive topics included clarification of the following:

- While aspirin and other over-the-counter medications may be covered as preventive, they are only covered where they are prescribed by a provider.

- Removal of a polyp during a screening colonoscopy is still considered preventive and cost-sharing may not be imposed. (It is currently a common practice to impose cost-sharing on a colonoscopy if a polyp is discovered during the procedure.)

- A recommendation for genetic counseling and evaluation for routine breast cancer susceptibility gene (BRCA) includes the BRCA test itself.

- Where preventive services are only appropriate for individuals identified as “high risk” that determination is to be made by the individual’s provider.

- Immunizations recommended by the Advisory Committee on Immunization Practices (ACIP) must be covered without cost-sharing. Recommendations are typically population-based, risk-based, or catch-up recommendations. In cases where an ACIP recommendation is applicable to an individual (rather than a population), the individual’s provider should determine whether a vaccine should be administered. If the provider has so determined, the immunization must be covered without cost-sharing.

- The Agencies have provided for transition relief for new ACIP recommendations. Any immunizations following new ACIP recommendations must be covered without cost-sharing by the first day of the plan year beginning one year on or after the date the recommendation is issued.

- Reasonable medical management techniques may be used to determine the frequency, method, treatment or setting of services provided during a well-woman visit. At least one well-woman visit a year is appropriate, although more may be necessary to provide all of the recommended preventive services.

- Screening for domestic violence is suggested by the guidelines. Screening may be accomplished by “a few, brief, open-ended questions.” Brochures and other assessment tools may be used.

- The guidelines recommend all FDA approved contraceptive methods, sterilization procedures and education and counseling for women be covered as preventive where prescribed by a provider. As a result, a plan may not limit preventive coverage to oral contraceptives only. However, reasonable medical management techniques may be used to control costs and promote efficient delivery of care; for example, covering a generic, but imposing cost-sharing for a brand drug.

- The FAQs provide that coverage for lactation counseling and for the costs of renting or purchasing breastfeeding equipment extends for the duration of breastfeeding, although plans may apply reasonable medical management techniques to determine coverage limitations.

Certain other discreet topics on preventive services are covered in the FAQs, which may be accessed here.