Legal Update

Mar 15, 2013

Issue 58: IRS Employer Mandate Clarification Spells Relief for Employers Contributing to Multiemployer Plans

This is the fifty-eighth issue in our series of alerts for employers on selected topics in health care reform. (Click here to access our general summary of health care reform and other issues in this series) This series of Health Care Reform Management Alerts is designed to provide an in-depth analysis of certain aspects of health care reform and how it will impact your employer-sponsored plans.

On March 15th, the IRS published a series of clarifications and technical changes to the proposed regulations on the employer mandate. As described in greater detail in Issue 48, the proposed regulations contained limited, lackluster transition relief for employers contributing to multiemployer plans. The clarifications appear to significantly expand this relief, at least for the 2014 calendar year.

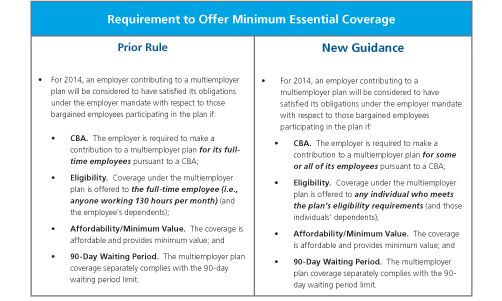

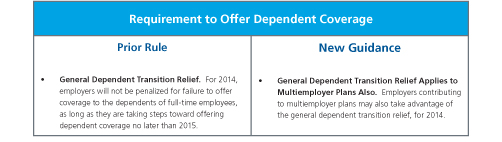

The following chart summarizes the changes:

Most notably, for employers contributing to multiemployer plans, the revised regulations relax the initial eligibility requirements for certain employees, at least during the 2014 calendar year. With this revised transition relief, an employer participating in a multiemployer plan could avoid a penalty for collectively bargained employees even if the multiemployer plan coverage does not begin within three months of the employee’s date of hire - as long as coverage is offered to those individuals who meet the multiemployer plan’s eligibility provisions. To be sure, multiemployer plans would still need to provide affordable, minimum value coverage for contributing employers to avoid penalties, but many multiemployer plans already provide such coverage.

While the revised regulations still require that multiemployer plans comply with the 90-day limit on waiting periods, those rules (which apply to group health plans) provide much greater flexibility than the employer mandate rules (which only apply to employers). For instance:

- The employer mandate requires that large employers offer coverage to all full-time employees (based on facts and circumstances at the date of hire) within three months of hire.

- The proposed rules regarding the 90-day limit on waiting periods that applies to group health plans, however, suggest that the 90-day “clock” may start “ticking” after the employee satisfies any otherwise applicable eligibility criteria (as long as the criteria do not relate solely to the passage of time).

As a result, under the revised transition relief, if the multiemployer plan is complying with the 90-day waiting period limit, a contributing employer could avoid a penalty, even if its employees are not actually covered within three months of their date of hire.

The revised regulations do not shed any light on what requirements might apply starting in 2015. As mentioned in Issue 48, comments are due on the proposed regulations (as revised) no later than March 18th.