Legal Update

Dec 3, 2012

Issue 46: Essential Health Benefits, Actuarial and Minimum Valuation and Cost-Sharing Guidance Issued

This is the forty-sixth issue in our series of alerts for employers on selected topics in health care reform. (Click here to access our general summary of health care reform and other issues in this series.) This series of Health Care Reform Management Alerts is designed to provide an in-depth analysis of certain aspects of health care reform and how it will impact your employer-sponsored plans.

As part of the series of guidance published November 26th on health care reform, the Department of Health and Human Services (HHS) issued proposed regulations that would provide guidance on determining essential health benefits (EHB) and actuarial valuation (AV) for health insurers offering individual and small group coverage. The proposed regulations also provide guidance on calculating minimum value (MV), which is relevant for determining whether a large employer will be penalized under the Employer Mandate provisions. [Click here for our recent alert on Play or Pay.] Finally, HHS discusses in the preamble the extent of the application of the cost-sharing requirements on self-funded and large group market plans.

By 2014, states must establish exchanges that will offer insured “qualified health plans” for purchase by individuals and small employers. Generally speaking, these qualified health plans will (i) provide EHB, (ii) have certain cost-sharing limits, and (iii) meet certain actuarial values (bronze, silver, gold, platinum -- called “metal” levels).

|

As of November 28th, 17 states (plus the District of Columbia) have indicated that they will establish their own exchanges, another 6 are planning for a partnership with a Federal exchange, and 17 have indicated that they will not do either and default to the Federal exchange. That leaves 10 states undecided. Secretary Sebelius has extended the deadline to December 14th for the states to determine whether they will establish their own exchange or let the Federal government do so for them. |

Essential Health Benefits Determined by Benchmark Plans

The proposed regulations continue the approach previously communicated by HHS (see Issue 36), which provided for EHB to be determined at the state level, based on benchmark plans selected by the state. A state may select its benchmark plan from among the following:

-

Small group market health plan. The largest health plan by enrollment in any of the three largest small group insurance products in the state’s small group market.

-

State employee health benefit plan. Any of the largest three employee health benefit plan options by enrollment offered and generally available to state employees in the state involved.

-

FEHBP plan. Any of the largest three national Federal Employees Health Benefits Program (FEHBP) plan options by aggregate enrollment that is offered to all health-benefits-eligible federal employees.

- HMO. The coverage plan with the largest insured commercial non-Medicaid enrollment offered by a health maintenance organization operating in the state.

In the absence of a selection, the benchmark plan will default to the largest plan by enrollment in the state’s small group market.1

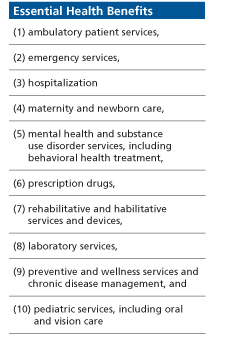

The benchmark plan will be required to meet standards detailed by the proposed regulations. For example, it must provide a balance of benefits among the ten categories set forth in the Affordable Care Act for EHB (see the box to the right for a list), and cannot have a benefit design that results in discrimination against individuals with significant or high cost health care needs.

The benchmark plan would serve as a reference for EHB for health insurance issuers. HHS selected this approach to allow states to build on coverage already widely available, minimize market disruption and provide consumers with familiar products. Presumably all benefits offered under the benchmark plan would be EHB, even if they are broader than the ten categories. Some substitution would be permitted if the benefits are actuarially equivalent.

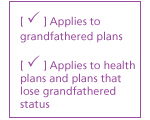

Note, self-funded plans and insured plans in the large group market are not directly required to provide EHB, but any EHB offered under such a plan must not be subject to an annual dollar limit after 2013. As a result, HHS has indicated that such plans must choose a benchmark plan to be able to identify the EHB that the plan offers.

Actuarial Value

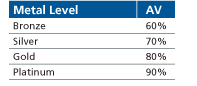

Qualified health plans offered on the exchanges will be required to meet certain actuarial values (AV). A plan’s AV, within a proposed 2% de minimis variation, determines its metal level (bronze, silver, gold or platinum) and measures the percentage of expected costs the plan will cover for a standard population.

Under the proposed regulations, the issuer would either use the AV calculator developed by HHS or obtain an actuarial certification to determine its level of coverage. In the small group market, annual employer contributions to HSAs and amounts newly made available under HRAs for the current year would be taken into account in determining AV.

Minimum Value

Beginning in 2014, a large employer could face a penalty if it offers health coverage that is either not affordable or does not provide “minimum value” (MV). A plan provides MV if it covers at least 60% of the total allowed  costs of benefits provided under the plan. This is comparable to a bronze level plan on the exchanges. Consistent with prior guidance, to calculate the percentage of the total allowed costs of benefits provided under the plan, a plan may utilize either an MV calculator to be made available by HHS and the IRS, or any safe-harbor established by HHS and the IRS. Plans with non-standard benefit designs may have an actuary certify that the plan provides MV. The MV calculation should take into consideration employer contributions to an HSA and amounts newly made available under an HRA.

costs of benefits provided under the plan. This is comparable to a bronze level plan on the exchanges. Consistent with prior guidance, to calculate the percentage of the total allowed costs of benefits provided under the plan, a plan may utilize either an MV calculator to be made available by HHS and the IRS, or any safe-harbor established by HHS and the IRS. Plans with non-standard benefit designs may have an actuary certify that the plan provides MV. The MV calculation should take into consideration employer contributions to an HSA and amounts newly made available under an HRA.

Cost-Sharing

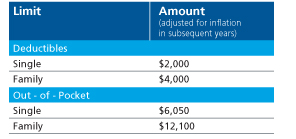

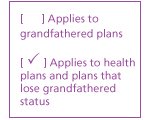

The Affordable Care Act sets the following limits on cost-sharing for non-grandfathered plans, starting with plan years beginning on or after January 1, 2014:

It was unclear whether these limits applied to all non-grandfathered plans, or only those plans offered through the exchanges and in the individual and small group insurance market. There is still some uncertainty, as the regulations reserved this discussion for a future date. Even so, HHS specifically commented in the preamble that the annual cost-sharing limitations imposed on group health plans (at least with respect to the deductible limitations) will only apply to plans and issuers in the small group market -- and not to self-insured plans or large group market insured plans. Also, the preamble clarified that the out-of-pocket maximum limits only apply to services provided in-network. It remains to be seen whether the regulators will limit the applicability of the out-of-pocket maximum rule to plans offered through the exchanges or in the individual and small group insurance market. Nonetheless, this clarification is significant for sponsors who are trying to design an affordable plan option at the bronze level and need to increase the deductible to do so.

reserved this discussion for a future date. Even so, HHS specifically commented in the preamble that the annual cost-sharing limitations imposed on group health plans (at least with respect to the deductible limitations) will only apply to plans and issuers in the small group market -- and not to self-insured plans or large group market insured plans. Also, the preamble clarified that the out-of-pocket maximum limits only apply to services provided in-network. It remains to be seen whether the regulators will limit the applicability of the out-of-pocket maximum rule to plans offered through the exchanges or in the individual and small group insurance market. Nonetheless, this clarification is significant for sponsors who are trying to design an affordable plan option at the bronze level and need to increase the deductible to do so.

What This Means For Employers

- Consider whether you would like to submit comments to the Department regarding these proposed regulations (comments are due January 25, 2013).

- When designing plan options for 2014 consider adjusting the deductible to establish a “bronze” level option.

- Continue to monitor guidance to determine how self-funded plans select a “benchmark” plan for purposes of determining EHB and removing annual dollar limits.

_________________________

1 For more information on the benchmarks selected by each state, click here...