Legal Update

Nov 27, 2012

Issue 45: Will You Owe a Penalty in 2014?

This is the forty-fifth issue in our series of alerts for employers on selected topics on health care reform. (Click here to access our general Summary of Health Care Reform and other issues in this series.) This series of Health Care Reform Management Alerts is designed to provide an in-depth analysis of certain aspects of health care reform and how it will impact your employer-sponsored plans.

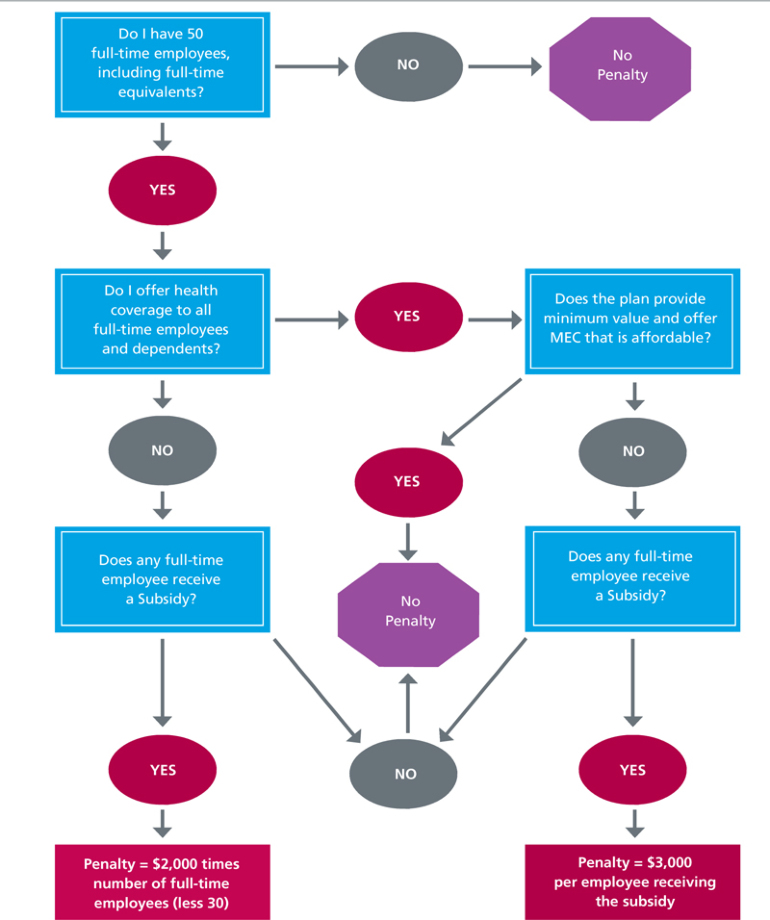

This issue focuses on the Play or Pay provisions of health care reform which are effective January 1, 2014. At that time, employers with at least 50 full-time employees, including full-time equivalents, will be required to pay a penalty if they fail to provide certain health coverage to their full-time employees.1 Specifically, the employer must provide minimum essential coverage (MEC) to all full-time employees (and their dependents) in order to avoid a penalty if a single full-time employee receives a tax credit or cost-sharing reduction2 (a "Subsidy"). In addition, the MEC must be affordable and must provide minimum value.3

To assist you in determing if you may owe a penalty, answer the questions in the flowchart below. If you have concerns about the possibility of a penalty, consider these planning posssibilities:

-

Decide Whether to Play and/or Pay. If you want to avoid a penalty, you must offer the requisite affordable MEC. Alternatively, you may decide to not offer coverage, pay the applicable penalty, and redesign compensation arrangements for full-time employees.

-

Design a Hybrid Approach. In between offering affordable MEC and not offering any coverage, there are various "hybrid" approaches where an employer can offer coverage to a portion of its population and pay the applicable penalty for the remainder. For example, you could structure employee contributions so that low-wage earners qualify for a Subsidy and then pay the $3,000 penalty for those employees who elect coverage through an Exchange. Alternatively, you could structure a plan for a select group of employees and pay the $2,000 penalty for all full-time employees, provided the arranagements meet the nondiscrimination rules.

- Hire More Part-Time Employees. Although part-time employees are included in determining whether you are a large employer with at least 50 full-time employees or full-time equivalent employees, employers do not have to provide health coverage to part-time employees. Employers who do not cover part-time employees, however, must be careful in categorizing these employees each measurement period. (See Issue #43).

To Do List

Although the following is not an exhaustive list and your "To-Do List" will vary depending on how you decide to design your health plans, here are a few things you may want to consider doing:

- Set up systems to classify new and ongoing employees as full-time, part-time, variable or seasonal. Ensure that any independent contractors are not common law employees.

- Identify your measurement and stability periods.

- Make sure plan documents cover all employees who are determined to be full-time employees within the applicable measurement period throughout the stability period.

- Amend your plan documents to ensure employees who switch from full-time to part-time don't lose coverage until the end of the stability period.

- Consider providing employees with information about their total compensation, including the total cost of health benefits (employer and employee contributions) (Note: If you have more than 250 employees, you may be required to report this information on employee Forms W-2.)

- If you have collectively bargained employees, ensure that full-time employees are, provided with affordable MEC under the terms of the bargaining agreement and that future bargaining agreements contain language that will allow you to redesign your plans in accordance with applicable health care reform guidance.