Legal Update

Apr 11, 2022

Further Guidance on Enhanced ESG Disclosures in Hong Kong Financial Markets

By: Raymond Wong and Jing Li

Background

Investors and asset managers continue to emphasize environmental, social, and governance (“ESG”) factors as drivers of financial value in their investment products.

In line with other international regulatory and standard setting bodies, like the US Securities and Exchange Committee and the International Sustainability Standards Board (see our firm’s article here), Hong Kong regulators will introduce a “mandatory” Task Force on Climate-Related Financial Disclosures (“TCFD”)—aligning climate-related disclosures across relevant sectors by 2025 as a part of a five-point sustainable finance strategy previously announced by the Green and Sustainable Finance Cross-Agency Steering Group. Financial markets in HK are largely regulated by the Hong Kong Securities and Futures Commission (“SFC”) and The Stock Exchange of Hong Kong Limited (the “HKEX”).

Spearheading developments on this front, the SFC issued a revised circular in June 2021 (the “2021 Circular”), superseding the previous 2019 version, on the requirements applicable to SFC-authorized unit trusts and mutual funds that incorporate ESG factors as their key investment focus and reflect such in the investment objective and/or strategy (“ESG Funds”), with effect from 1 January 2022.

The HKEX has also steered its listed issuers towards TCFD in its new ESG reporting guide. With effect from July 2020, the Exchange’s ESG Reporting Guide has been amended to incorporate elements of the TCFD recommendations, such as requiring the board’s oversight of ESG matters, targets for certain environmental KPIs, and disclosure of the impact of significant climate-related issues.

SFC Initiatives—the 2021 Circular

The new guidance under the Circular 2021 sets out the implications for ESG Funds, some of which are as described below.

Disclosure in Offering Documents

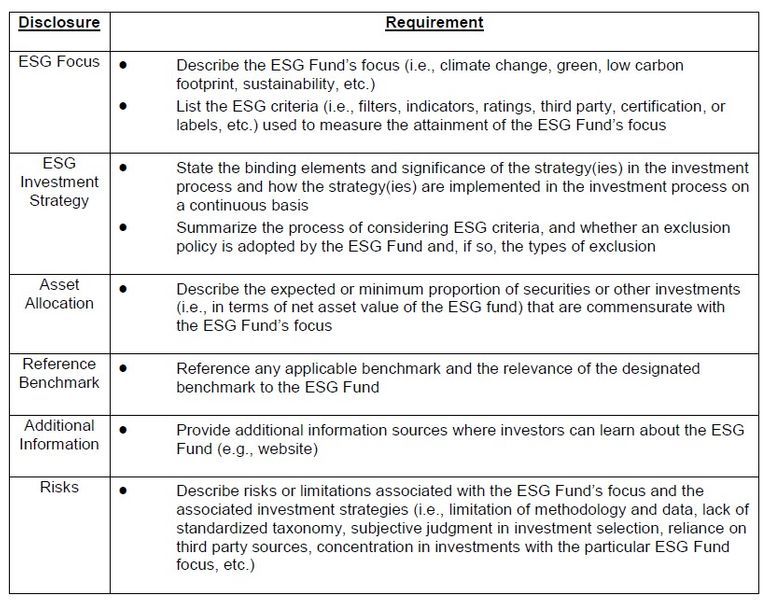

Under 6.1 of the Code on Unit Trusts and Mutual Funds, offering documents must provide the necessary information to enable investors to be able to make an informed judgement of the investment.

Disclosing Additional Information

The 2021 Circular also requires ESG Funds to disclose additional information, including how the ESG focus is measured and monitored through the lifecycle of the ESG Fund, methodologies adopted, engagement policies (if any), description of the sources and processing of ESG data, or applicable assumptions.

Period Assessment

There is now a new requirement under the 2021 Circular for ESG Funds to conduct at least an annual assessment to demonstrate how they have attained their ESG focuses. These disclosures should be made periodically through appropriate means (i.e., annual reports), including:

- a description of how the ESG Fund has attained its ESG focus during the assessment period;

- a description of the basis of the assessment performed, including any estimations and limitations; and

- where the ESG Fund has provided previous periodic assessment, a comparison between the current and at least the immediately preceding assessment period.

Impact on Undertakings for the Collective Investment in Transferable Securities (“UCITS”) Funds

Out of more than 100 SFC-authorized ESG Funds, seven such funds are domiciled in Hong Kong, while the remaining are EU-domiciled funds marketed in the EU markets as UCITS[1]. The SFC has been adopting a streamlined approach to the authorization of UCITS funds from specified jurisdictions.

Having considered the European regulations on sustainability-related disclosures in the financial services sectors (“SFDR”), SFC has recognized UCITS funds as ESG Funds if they incorporate ESG factors as their key investment focus and reflect that focus in their investment objective or strategy (“UCITS ESG Funds”). UCITS ESG Funds that meet the disclosure and reporting requirements for funds under the SFDR will be deemed to have generally complied in substance with the disclosure requirements under the 2021 Circular.

Ongoing Monitoring Requirements and Consequences of Non-Compliance

An ESG Fund will be removed from the SFC’s authorized list on its dedicated ESG Funds webpage if it is no longer able to meet the requirements under the 2021 Circular.

Fund managers should also note that in addition to the removal of the fund from the SFC’s list of ESG Funds, the SFC may take appropriate regulatory action against the fund manager for funds that are in breach of the 2021 Circular.

The HKEX’s ESG Reporting Guide

The HKEX first introduced the ESG reporting guide in 2012 for voluntary disclosure of ESG information. Following revisions in 2016 after a market consultation, the HKEX adopted enhancements to the then existing ESG reporting regime in December 2019 (“ESG Guide”), which has been effective as of July 2020. The ESG Guide, which forms an appendix to the Listing Rules of the Hong Kong Stock Exchange, provides a framework for listed issuers to, among other things, identify and consider what environmental risks and social risks may be material to them. Under the ESG Guide:

- a listed issuer’s board is responsible for effective governance and oversight of ESG matters, as well as assessment and management of material environmental and social risks; and

- a listed issuer is required to disclose environmental and social matters in its ESG report in accordance with the ESG Guide.

In ESG report must be published on an annual basis and covers the same period as in the listed issuer’s annual report. It could be published as part of an annual report or in a separate report. Regardless of the format adopted, the ESG report must be published on the Exchange’s website and the issuer’s website.

For ESG reporting covering the financial year 2021, an issuer must publish its ESG report within five months after the financial year end. For the financial year commencing on or after 1 January 2022, an issuer is required to publish its ESG report at the same time as the publication of its annual report.[2] Further, the Hong Kong Corporate Governance Code has recently been revised[3] to clarify that “risks” for the purpose of evaluation and determination by the board of an issuer would include ESG risk and that the annual review of risk management and internal control by the board would therefore have to cover ESG risk as well.[4]

* * *

Please reach out to the authors for assistance with ESG disclosures for Hong Kong financial markets. Seyfarth’s trans-disciplinary ESG, Corporate Citizenship & Human Rights team uses a holistic approach to provide a full range of services across the ESG landscape.

[1] According to the List of SFC-authorized ESG Funds in March 2022: https://www.sfc.hk/en/Regulatory-functions/Products/List-of-ESG-funds

[2] Rule 13.91(d) of the Hong Kong Listing Rules

[3] The revised Corporate Governance Report has been effective since 1 January 2022

[4] D.2 Principle of the Hong Kong Corporate Governance Code

Seyfarth Shaw LLP provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from their professional advisers.