Legal Update

Jun 4, 2020

An M&A Guidebook for a Post-Pandemic World

Creative Ways to Bridge the Gaps Between Buyers and Sellers After COVID-19

By Paul Pryzant

Sign Up for our COVID-19 Mailing List.

Visit our Beyond COVID-19 Resource Center.

COVID-19 has created unparalleled uncertainty for nearly all businesses since companies are unable to predict when and how businesses and consumers will resume buying their goods and services. This unpredictability has made it more difficult for dealmakers to use historical earnings to predict a company’s future earnings, and accordingly their valuation, which has severely curtailed the number of M&A transactions at the present time. Yet somehow, a trickle of deals are getting done, and others are being pursued, although at a much slower pace than in 2019. This Legal Update will discuss how the new environment has caused a shift from a seller’s market to a buyer’s market in the space of a few months and has changed elements of the M&A deal process and due diligence. It also discusses different ways deals can be structured to allocate the risks between buyers and sellers in a post-COVID world, and changes in the ways transactions will be financed.

Why would buyers and sellers want to do a deal in this environment?

Buyers with available funds may find that the current environment provides opportunities that would not have existed before the pandemic. In particular, strategic buyers with deep industry expertise will look for transactions that will allow them to add a new product, service, or acquire new technology or a set of skilled employees, or some combination of these. Private equity buyers have a lot of available funds to invest and will need to deploy capital, especially if they perceive this to be a buyer’s market. One of the pandemic's principle effects for M&A transactions has been to lower seller valuation expectations, motivating sellers to be more flexible than they were only a few short months ago. As a result, valuation expectations are materially lower for sellers, making it easier to structure a transaction that makes sense for both parties.

Throughout this Legal Update, when we refer to “private equity”, we generally mean platform acquisitions by a private equity fund, which are acquired to be a standalone portfolio company, as opposed to a “tuck-in” acquisition by a portfolio company. By “strategic buyer”, we generally mean an existing company already operating in an industry, which can include both public and private companies, and can include a private equity portfolio company looking for a tuck-in acquisition.

Many young start-ups and technology companies may lack sufficient cash resources to weather the storm and may be unable to find additional funding quickly enough. This predicament may increase the attractiveness of a larger strategic buyer capable of providing stability and added resources that the seller and its employees sorely need. Sellers may have other reasons to seek a sale, including the death or divorce of a founder, wanting to get some needed liquidity to provide some diversification for the owners, or a management team that has reached its limits for moving the company forward. Such sellers may have been trying to find a buyer before COVID-19, and do not have the luxury of waiting a year or longer for a more favorable selling environment. There are also distressed situations in which a company may face insolvency and bankruptcy, but transactions involving bankruptcy have very different rules and considerations which are beyond the scope of this Legal Update.

How has due diligence and the M&A process changed in the post-COVID environment?

Acquisitions are typically the start of a long-term relationship between the seller's management team and the buyer, the success of which depends heavily on the seller's key employees. For buyers, face-to-face meetings with the seller’s management team remain a critical component of deal-making and due diligence, and few buyers will be willing to close a transaction without several opportunities to interact in person with the management team. Most deals closing today were likely underway before the pandemic, so the buyer already had spent time with the seller and the seller’s management team. Due to the challenges posed on travel by COVID-19, the nature of due diligence on the management team is likely to change. For new transactions in which the buyer has no prior relationship with the seller, video conferences will allow the sale process to get started between motivated parties. For now, however, buyers will likely insist on meeting the management team in person before they are willing to close the deal.

If travel remains constrained for an extended period, buyers may need to re-think their dependence on face-to-face meetings. Similar to hiring decisions, sooner or later, buyers will become more comfortable with video conferencing, both for getting to know the management team during due diligence and then for interacting with them post-closing. Buyers may also increase their use of personality tests and similar assessment tools to better understand the management teams of the seller during due diligence. You can also expect to see buyers becoming more structured in their due diligence discussions on video conferences, similar to the hiring methodology Geoff Smart and Randy Street recommend in their book, Who - The A Method for Hiring. While right now, partners at private equity funds and strategic buyers may say that they would never buy a company without extensive meetings with the management team in person, this attitude could change if the effects of the pandemic persist.

The inability to meet with the seller’s management in person is one of several reasons to extend the due diligence time period. An extended due diligence period allows the buyer more time to assess more accurately COVID-19’s impact on the seller and to find any needed financing for the deal. As a result, look for the exclusivity period in letters of intent to be extended from the typical period of 60 days pre-COVID to 90 or 120 days, if not longer.

The nature of due diligence will strongly depend on whether the key assets of the seller are intellectual property, such as for a software company, or whether the key assets are physical, such as inventory or a factory or distribution facility. The more the key assets are physical, the more likely the buyer (and the buyer’s lenders) will require physical inspections that will lengthen the closing timetable.

Certain physical assets, such as a factory or distribution facility, will require more rigid due diligence on new health and safety measures put into place to protect workers at the facility. Similar to having Phase I environmental reports for real property, third-party health and safety inspections will need to be added to due diligence checklists for physical facilities.

The pandemic provides new lines of questions to ask the management team to better assess their capabilities and the operations of the target business.

- What decisions did you make to cope with the pandemic, and why? How did they turn out? How did you treat your employees and vendors? What did you learn and what would you do differently?

- What is the seller’s supply chain vulnerability, especially to China and other overseas sources? What plans does management have to change the supply chain in a post-COVID world?

- What additional operating costs are required to operate in a post-COVID world?

- What plans does management have if the pandemic re-emerges in the Fall?

Buyers will also ask if the seller received a loan under the Paycheck Protection Program (PPP), and especially if the loan was for more than $2.0 million so that it is subject to the automatic audit promised by the Small Business Administration (SBA). Buyers should ask about the seller’s eligibility for a PPP loan under the SBA’s affiliation rules. Buyers will be leery about buying a company subject to an SBA audit when the seller’s eligibility was questionable or there are questions regarding the seller’s good faith certification regarding the “necessity” of the loan.

Due to the shift from a seller’s market to a buyer’s market, sellers will need to find ways to distinguish themselves. One way to do that is to make the due diligence easier and more transparent for the buyer. In this new environment, sellers should make the up-front investment in pre-sale due diligence. This will include investing in a more thorough quality of earnings (Q of E) reviews before starting the sale process. This will provide the buyer with better visibility into the seller’s pre-COVID performance and how they will manage through the disruptions caused by the pandemic. Sellers will also want to prepare “stress test” analyses for their business under different possible scenarios in a post-COVID world. Buyers will find sellers with more transparent financial data, and a plan for an uncertain future, to be much more attractive. These types of “stress test” analyses are critical to help develop more creative deal structures required under the current environment, as discussed below.

What are ways to bridge the valuation gap given the uncertainty in the seller’s future financial performance?

I. Setting the Stage - Valuation Methodologies and Changing Expectations

Three common ways to value target companies are:

- Multiple of prior 12 months of EBITDA, which is used for companies with earnings. This is the most common valuation methodology.

- Multiple of revenues, most commonly used for software and other technology companies which have been able to build significant sales but are not at the stage of having earnings.

- A “build versus buy” analysis, in which the buyer assesses the cost to duplicate the functionality of the seller’s product or technology from scratch, versus the cost to buy the seller and its employee team. This measure is most commonly used for early-stage software and other technology companies prior to them having significant sales revenues. Acquisitions of these types of companies are especially attractive if they have a skilled set of employees who can jump-start the buyer’s efforts to add a new product or service, or technology. This valuation methodology generally leads to lower valuations, but not always, depending on the immediate needs of the buyer. When Facebook paid $1 billion for Instagram in 2012 for a one-year-old company with thirteen employees, it sounded crazily high at the time, but in retrospect, it has turned out to be a bargain.

A seller’s historical earnings are no longer a predictable measure of future performance due to the uncertainty caused by COVID-19. Before the pandemic, in a seller’s market, the multiples of EBITDA and revenue used to value sellers were at all-time highs, with auctions attracting a large number of potential buyers. Using trailing 12 months (TTM) of EBITDA, or TTM of revenues were reasonable ways for buyers to predict future financial performance. COVID-19, however, has upended these metrics as a way to value companies. How do you value a company after COVID-19 when you cannot predict with any certainty how a company will perform over the next 12-18 months? For the “build versus buy” valuation analysis, the changed environment probably will not materially change the buyer’s analysis, but it has substantially changed the seller’s expectations, making them more receptive to an acquisition.

One big difference between the current environment and prior recessions, such as 2008-09, is that sellers have quickly grasped the uncertainty caused by the pandemic. In prior recessions, it took 12-18 months for sellers to fully understand the new reality. Today, sellers’ expectations have re-set almost immediately. Sellers that have the staying power and resources to wait may be content to wait it out until conditions improve. Sellers who have other pressures may be more motivated to sell, notwithstanding the current uncertainty, and more willing to share the risks with the buyer. From the buyer’s perspective, and especially for strategic buyers, if a target company is a strategic fit that provides a new product or service, or new technology or a skilled group of employees, this may still be a good time to make an acquisition. If both the buyer and seller are motivated and are willing to be more flexible than before the pandemic, then deals can still happen.

How do you bridge the valuation gap to deal with the uncertainty caused by COVID-19? The answer is to creatively allocate the uncertainty risk between buyer and seller. The tools to do this can differ for private equity and strategic buyers.

II. Tools to Bridge the Valuation Gap

1. Reduced Total Purchase Price and Reduced Cash at Closing

Companies that are valued as a multiple of earnings or revenues are not worth as much today as they were in January 2020 in the pre-COVID world. Particularly attractive companies that were in auction processes in January 2020 with multiple bidders may have received bids of 10X of 2019 EBITDA, with 90%+ of the purchase price paid in cash at closing. In the current environment, however, a more realistic multiple might be 8X or 9X of 2019 EBITDA, with only 50% to 60% of the purchase price paid in cash at closing. The remaining portion of the purchase price will be contingent, deferred, or subject to an equity rollover, using some of the tools laid out in more detail below.

2. Earn-outs

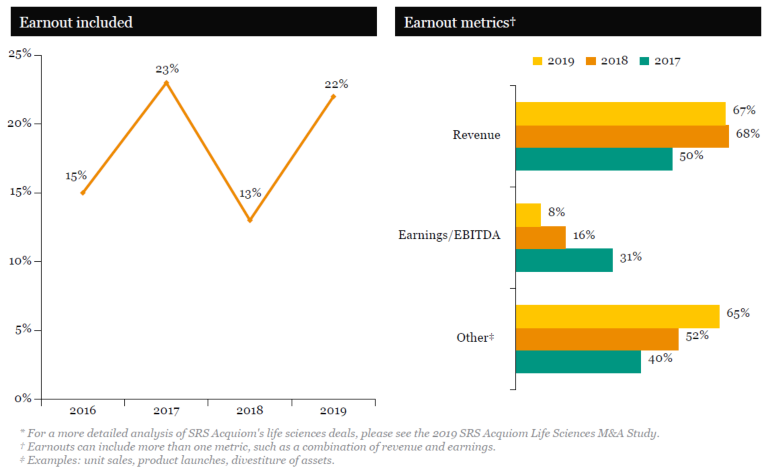

Earn-outs are a tool that can be used by both private equity and strategic buyers. According to the 2020 M&A Deal Terms Study by SRS Acquiom (the “SRS Study”), which analyzed 1,200+ private-target acquisitions from 2015 to 2019 (i.e., the pre-COVID period), earn-outs for non-life science deals were used in an average of approximately 18% of transactions over the past four years, as shown the chart below. Since earn-outs are used more frequently in life science transactions, the SRS Study excluded those transactions to get a better measure of how earn-outs are used in non-life science transactions. For transactions with earn-outs, the metrics used were revenues, EBITDA, and other milestones (such as unit sales or product launches), or sometimes combinations of these metrics, depending upon the business and the stage of development of the target company. The chart below shows how the use of these metrics has changed.

Source: 2020 M&A Deal Terms Study by SRS Acquiom

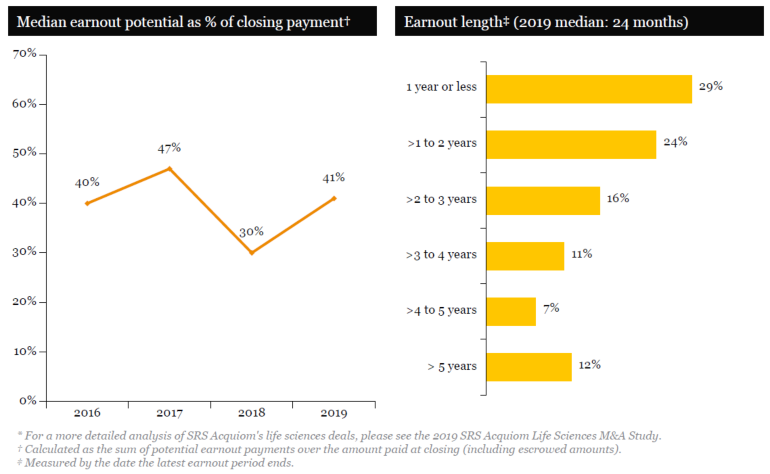

According to the SRS Study, the charts below show that in non-life science transactions with earn-outs, the earn-out potential as a percentage of the closing payment generally hovered around 40% and the length of the earn-out period ranged from less than one year to more than five years, with a median of 24 months.

Source: 2020 M&A Deal Terms Study by SRS Acquiom

In the pre-COVID world, both buyers and sellers have been wary of using earn-outs. Earn-outs have often half-jokingly been referred to as “litigation magnets” since disputes regarding whether the earn-out has been achieved have become common. Some of the reasons for the disputes have been due to ambiguous metrics for determining whether the earn-out has been met, changes in the buyer’s operations post-closing, the allocation of expenses, and the difficulty caused by changing circumstances, especially when the earn-out period is long (more than two years). As a result, in the pre-COVID world, earn-outs were imperfect tools that were used only when absolutely necessary to bridge the valuation gap between buyer and seller.

In the post-COVID world, however, earn-outs will become increasingly popular to allocate more risk to the seller for the uncertainty of future performance. As a result, these are likely changes for earn-outs:

- Earn-outs will be used in a higher percentage of transactions, from the current 18% to perhaps 30% to 40% of deals, or higher.

- The time period for earn-outs will increase from the current median of 24 months to longer time frames. Given the uncertainty with how long it will take for companies to recover from COVID-19, most companies have no visibility into what their results will be for 2020, and even into 2021. Therefore, earn-out periods may extend into 2022 and 2023, and longer, to give the seller more opportunity to achieve the earn-out.

- The earn-out potential as a percentage of the closing payment can be expected to increase from the current 40% to 50% or higher.

3. Equity Rollovers

Equity rollovers are a tool used almost exclusively by private equity buyers in platform acquisitions, and sometimes for tuck-in acquisitions. Equity rollover transactions typically involve rollover participants taking between 10% and 40% of the purchase price in the form of equity in the buyer. Equity rollovers are generally restricted to founders and other members of the seller’s management team who are joining the buyer post-closing. This provides founders and management with a meaningful equity stake in the buyer to align their respective interests to grow and sell the target company. Generally, existing equity holders in the seller who are not founders or part of the management team (i.e., venture capital, private equity or angel investors) are excluded from the equity rollover since they have no ongoing role with the buyer post-closing and would rather exit the investment in the seller. Private equity buyers also like equity rollovers since they serve as a form of seller financing which reduces the buyer’s up-front cash payments at closing.

Equity rollovers were already very common before the COVID-19 pandemic. In the future, they will likely be used as a tool to allocate more risk to the seller to deal with the unpredictability of post-COVID financial performance. Below are some of the changes we are likely to see.

- The equity rollover percentage is likely to increase. Prior to the pandemic, a private equity buyer might have been agreeable to only a 10% or 20% rollover by the founders and management team. In the post-COVID world, the equity rollover percentage will likely increase to 30% or 40%, as a means of shifting more of the risk to the seller and decreasing the need for outside financing.

- The seller participants in the equity rollover are likely to expand to include more of the equity holders in addition to the founders and management team. The buyer may insist on having venture capital, private equity, or angel investors included in the equity rollover. This may not be ideal for those investors who may have wanted to completely exit their investment, but they may have no choice in the current environment. For the buyer, this shifts the post-COVID risk to more of the seller’s equity holders and increases the amount of seller financing.

- The private equity buyer may insist on having a liquidation preference for its equity, which will be paid out prior to the equity rollover received by the seller participants. In the pre-COVID world, it was typical for the seller participants to receive rollover equity with the same economic rights and preferences as the private equity buyer. In the current environment, however, private equity buyers are more likely to insist on receiving a 1X liquidation preference, or a 1X plus a return of some amount (i.e., 8%), to provide downside protection to the buyer. The buyer will argue that the seller participants have already cashed out a significant portion of their investment so that it is only fair for the buyer to be protected if the post-COVID performance of the seller is significantly worse than expected.

4. Targeted Incentive Bonus Plans for the Management Team

Strategic buyers generally will not use equity rollovers. The reasons include that the strategic buyer will have no timeline to sell the target company, so the rollover recipient will never be able to exit the investment, or the strategic buyer may be privately-owned by a family or other small group and have no desire to have any minority equity holders.

Strategic buyers also may not want to use earn-outs if the management team which is joining the buyer has a small equity stake in the seller. Therefore, an earn-out may increase the purchase price for the other equity holders of the seller (i.e., venture capital, private equity or angel investors), but the management team will not receive much of the earn-out due to its small equity holdings in the seller. As a result, the management team will not have the needed incentives to help the buyer achieve the desired results post-closing. This is particularly needed when the buyer is making the acquisition to acquire new software or other technology, as well as the skilled group of employees responsible for developing the technology (i.e., a so-called “acqui-hire”).

This situation, especially in a post-COVID world, requires the strategic buyer to be more creative in designing a structured incentive bonus plan for the management team. Even in a post-COVID world of higher unemployment, talented technology employees (and especially the “A” players) may still be able to find other attractive jobs or may be motivated to start a new company. As a result, the buyer needs to design targeted incentive bonus plans that may be outside the norm for the buyer and are specifically tailored to incentivize the management team to achieve specific buyer goals for the transaction. Below are some thoughts for what a targeted incentive bonus plan might include:

- Specific milestones that could include the development of new software or other products, or improving existing software or other products to meet market needs, in both cases using the larger resources of the buyer. These milestones may be part of a long-term project that may take two to five years to achieve, so accordingly, the incentive plan will need to have a longer-term horizon that matches the achievement of specific milestones.

- Specific milestones that could include sales or other financial targets for the software or other technology products acquired in the acquisition to connect the management team to the sales efforts for their products. These milestones may be combined with the other milestones in the prior bullet.

- Monetary rewards that are large enough to provide sufficient incentives for the management team to stay with the buyer. If the management team is being asked to create significant value for the buyer, then they should share in a portion of the value they create.

5. Purchase less than 100% of the Target Company’s Equity (with deferred purchase options for the balance).

In the typical rollover structure, the rollover participants cannot sell their rollover equity until the private equity fund sells the entire company. As discussed above, strategic buyers are unlikely to use rollover equity. However, a hybrid rollover structure that can be utilized by strategic buyers is to:

(i) purchase less than 100% of the Target Company’s equity in the initial closing (typically more than 50% of the equity, but less than 80% (to avoid consolidation for tax purposes)); and

(ii) purchase the balance of the equity at a later date, perhaps two to three years after the initial closing, based upon a pre-set formula to determine the purchase price based upon future performance.

This structure allows the seller’s equity holders to sell a portion of their equity at the initial closing, and provide some partial liquidity for their investment. In the post-COVID environment, the pricing multiple for the portion of the equity purchased at the initial closing may reflect some of the uncertainty for how quickly operations of the target company will get back to pre-COVID levels.

The second-step purchase of the remaining equity can use a pre-set formula to determine the purchase price, which will be based on the financial performance of the target company during a future time period. This structure provides potential upside to the seller if the financial performance improves within a reasonable time period, while at the same time providing downside protection to the buyer if the financial performance is permanently impaired or takes an extended time period to get back to pre-COVID levels. A variation of this structure is to provide for a combination of puts to allow the seller to require the purchase of the remaining equity at a pre-set formula, and calls to allow the buyer to require the sale of the remaining equity based on the pre-set formula, in each case at a future date.

For example, assume that buyer purchases 60% of seller’s equity at the initial closing at an 8X multiple of EBITDA (which might have been a 9X or 10X multiple in January 2020). The purchase agreement would provide that the remaining 40% of seller’s equity will be purchased by the buyer based on an 8X multiple of 2021 or 2022 EBITDA, perhaps with some minimum price to provide some downside protection to the seller’s equity holders. This structure allocates the downside risk to the seller of a slow or extended recovery while providing upside incentives to the seller if the target company’s financial performance improves more quickly. This structure can be especially advantageous for a smaller target company with limited sales and distribution resources of its product, or a new product with adoption risk, being acquired by a larger company with more extensive sales and distribution channels. Obviously, there can be many variations of this structure to fit the specific circumstances of the target business and to fairly allocate post-COVID uncertainty between the seller and the buyer.

How do buyers finance acquisitions in the current environment?

In January of this year, senior and mezzanine lenders were avidly competing to loan money to finance acquisitions. This led to an increase in the percentage of the purchase price that buyers could borrow to finance a deal and favorable loan terms with low interest rates and relaxed financial covenants. Life was good for buyers before the pandemic hit!

Today, the environment is very different since lenders are much more cautious. It will take time for lenders to become more comfortable after the economy opens up and they can get real-time information on the target company’s financial performance in the new environment. As a result, many senior and mezzanine lenders are sitting on the sidelines, or simply moving slowly, until the smoke clears to permit some visibility on how the target company is likely to perform over the next 12 - 36 months.

When lenders are willing to move forward, their appetite for risk is likely to be substantially reduced, meaning that buyers can expect the following changes:

- Due diligence will take longer and be more involved, especially when there are physical assets and facilities that need to be inspected. Mezzanine lenders in particular may look closer to home for financing transactions to eliminate the need to travel far to meet the management team.

- Lenders will reduce the percentage of the purchase price they are willing to finance, which will require the buyer to provide more equity.

- Interest rates, and other fees and expenses, will be higher than before. Interest rates may increase by 200 basis points, or more, than in 2019 to account for the increased risks. Closing fees and due diligence costs will also be larger than before the pandemic.

If outside financing is not obtainable at all, or not available at the desired level, then sellers and buyers will need to find new ways to allocate the financing risk in the post-COVID environment. We expect some combination of the following structures to be used in the coming months, some of which have already been discussed above:

- Reduce the cash portion of the purchase price payable at closing, and increase the amount of the equity rollover, and/or add an earn-out.

- Bridge any financing gap with seller notes, which would be subordinated to any senior or mezzanine lenders. In the current environment, this may be the only way to get a transaction financed. While the seller may request collateral or guarantees from the private equity fund or strategic buyer, buyers can be expected to react adversely to these requests, and expect the seller to bear the risk with the seller notes until the entire company can be recapitalized and the seller notes can be repaid.

- Provide for the buyer to pay an increased portion of the purchase price in cash at closing, and then recapitalize the company with an appropriate amount of debt after the lenders have better visibility on the target company’s financial performance in the post-COVID environment.

Like the rest of the economy, M&A participants and their advisors are having to deal with an extraordinary amount of uncertainty as a result of the COVID-19 pandemic. As a result, due diligence efforts and transaction structures are expected to change from a very pro-seller environment to one in which buyers and sellers will need to be more flexible and creative for how they allocate the valuation and financing risks between them. If a seller can wait for a more favorable environment, then they will do so. But many sellers will not be able to wait and will still desire to try to get a transaction closed. Similarly, private equity buyers have a lot of funds to invest and will need to deploy capital at some point, especially those with funds that have investment periods coming to a close. Cash-rich strategic buyers, and especially those looking for companies with new products and technology, may find this an attractive opportunity to acquire companies that are a strategic fit. This environment may present strategic buyers which are already familiar with the industry and the target company with great opportunities, especially if they are willing to move quickly and are willing to be more creative with their deal structures.

Axial has been hosting a series of COVID-19 virtual roundtables each week with different sets of middle market deal professionals, who have been sharing their views on how COVID-19 has been changing the way they view transactions in the current environment. These virtual roundtables inspired some of the ideas for this Legal Update and can be accessed here.