Legal Update

Jul 24, 2020

Main Street Money for Nonprofits

Sign Up for our COVID-19 Mailing List.

Visit our Beyond COVID-19 Resource Center.

The Federal Reserve Board (the “Fed”) recently released additional changes relating to the expansion of its Main Street Lending Program (the “Main Street Program”), which originally targeted small and medium-sized for-profit businesses only, to provide access to credit for nonprofit organizations. The proposed expansion would offer loans to small and medium-sized nonprofit organizations that were in sound financial condition before the coronavirus pandemic and could benefit from additional liquidity to manage through this challenging period. The Main Street Program was established to purchase up to $600 billion in loans from eligible lenders using funds appropriated to the Fed under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). This Legal Update summarizes the details of the proposed Main Street Program loans for nonprofits (“Nonprofit Main Street Loans”).

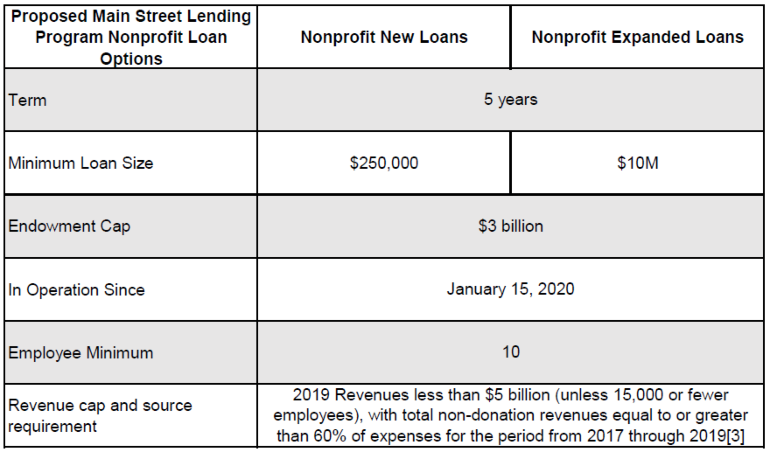

Two loan options—a “new loan” option (“Nonprofit New Loan”) and an “expanded/upsized loan” option (“Nonprofit Expanded Loan”)—are proposed. As a general matter, the terms of both Nonprofit Main Street Loans, including the interest rate, deferral of principal and interest payments, and five-year term, are the same as for Main Street loans for for-profit businesses, described in more detail here.

Eligible Borrowers

In addition to the eligibility requirements applicable to the borrowers under the other Main Street loans, such as the requirement to (i) be an entity organized in the United States or under the laws of the United States with significant operations in and a majority of its employees based in the United States, and (ii) not be an Ineligible Business (as listed in 13 CFR 120.110(b)-(j) and (m)-(s), and modified by regulations implementing the Paycheck Protection Program under the Cares Act), the eligibility requirements include:

- Nonprofit in continuous operation since January 1, 2015;

- Has an endowment of less than $3 billion;

- Has a ratio of adjusted 2019 earnings before interest, depreciation, and amortization (“EBIDA”) to unrestricted 2019 operating revenue[1] greater than or equal to 2%;

- Has a ratio (expressed as a number of days) of (i) liquid assets[2] at the time of the loan origination or upsizing to (ii) average daily expenses over the previous year, equal to or greater than 60 days; and

- At the time of loan origination or upsizing, has a ratio of (i) unrestricted cash and investments to (ii) existing outstanding and undrawn available debt, plus the amount of any loan under the applicable Nonprofit Main Street Loan, plus the amount of any CMS Accelerated and Advance Payments (made available under the CARES Act), that is greater than 55%.

Additionally, to qualify for the program, each organization must be a tax-exempt organization under section 501(c)(3) or 501(c)(19) of the Internal Revenue Code. Other forms of organization, such as 501(c)(4), 501(c)(5), 501(c)(6) and 501(c)(7) organizations, may be considered for inclusion as a Nonprofit Organization under the Nonprofit Main Street Loans at the discretion of the Fed.

Nonprofits that have taken advantage of the PPP may obtain a Main Street loan in addition to the PPP loan. However, nonprofit borrowers will only be eligible under the Main Street Program to obtain one Main Street Loan (i.e., a Nonprofit New Loan or a Nonprofit Expanded Loan) and must not also participate in the Fed’s Primary Market Corporate Credit Facility or Municipal Liquidity Facility.

Key Terms

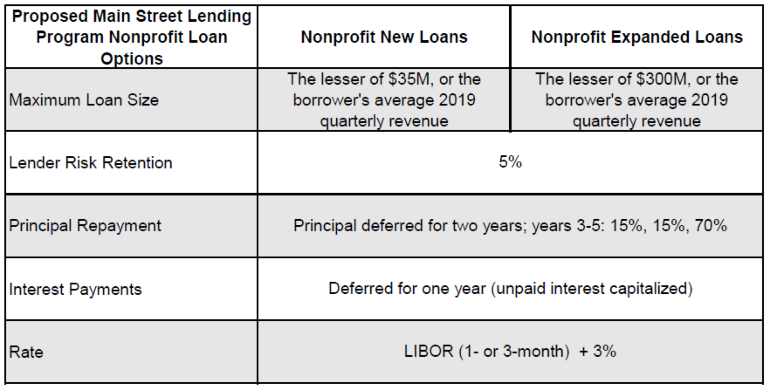

The chart below summarizes additional details on the key proposed terms.

Nonprofit New Loans

Loan sizes for Nonprofit New Loans (i.e., those originated after June 15, 2020) will range from a minimum principal amount of $250,000 up to a maximum principal amount that is the lesser of (i) $35 million or (ii) the borrower’s average 2019 quarterly revenue. New Loans may not be, at the time of origination and during the term of the loan, contractually subordinated in terms of priority to the borrower’s other loans or debt instruments. All Nonprofit New Loans will be term loans and may be secured or unsecured.

If the borrower had other loans outstanding with the lender as of December 31, 2019, such loans must have had an internal risk rating to the underlying loan equivalent to a “pass” in the Federal Financial Institutions Examination Council's (FFIEC) supervisory rating system as of that date.

Nonprofit Expanded Loans

The maximum size for the upsized tranche of any Nonprofit Expanded Loan (i.e., those originated on or before June 15, 2020) will range from a minimum principal amount of $10 million up to a maximum principal amount that is the lesser of (i) $300 million, or (ii) the borrower’s average 2019 quarterly revenue. Nonprofit Expanded Loans may be secured or unsecured term loans or revolving credit facilities.

To be eligible for “upsizing,” the existing secured or unsecured term loan or revolving credit facility must have been originated on or before June 15, 2020, and must have a remaining maturity of at least 18 months. The lender may extend the maturity of an existing loan or revolving credit facility at the time of upsizing in order for the underlying instrument to satisfy the 18-month remaining maturity requirement. At the time of upsizing and at all times the Expanded Loan is outstanding, the Expanded Loan must be senior to or pari passu with, in terms of priority and security, the borrower’s other loans or debt instruments, other than mortgage debt.

Both Nonprofit New Loans and Nonprofit Expanded Loans will have a term of 5 years, with principal amortization of 15% at the end of each of the third and fourth year, and a balloon payment of 70% at the end of the fifth year. Amortization on the loans will be deferred for two years and no payments of principal will be due during this period. As with Main Street loans for for-profit businesses, no interest payments will be required during the first year of either Main Street Nonprofit loan and unpaid interest will be capitalized.

The lender must have assigned an internal risk rating to the underlying loan equivalent to a “pass” in the FFIEC’s supervisory rating system as of December 31, 2019.

Other Terms

All Nonprofit Main Street loans may be prepaid without penalty and will be subject to an adjustable interest rate of 1- or 3-month LIBOR + 3%.[4] Lenders are permitted to charge borrowers of Nonprofit New Loans an origination fee of 1% of the principal amount of the applicable loan and borrowers of Nonprofit Expanded Loans an “upsizing” fee of 0.75% of the principal amount of the Nonprofit Expanded Loan. Additionally, the lenders will be required to pay the Nonprofit Main Street Program a transaction fee of 1% of the principal amount of any Nonprofit New Loan, or 0.75% of the principal amount of any Nonprofit Expanded Loan, at the time of origination or upsizing, as applicable, and may elect to pass this fee on to the borrower. The Nonprofit Main Street Program will cease participations on September 30, 2020 unless extended by the Treasury Department and the Fed.

Certifications and Covenants

As with other Main Street loans, various borrower and lender certifications and covenants will be required in connection with each Nonprofit Main Street Loan.

Borrower Certifications and Covenants

Borrowers must provide the required certifications and covenants in a writing executed on behalf of the borrower by its principal executive officer and principal financial officer or functional equivalents.

In addition to other certifications required by applicable statutes and regulations, the below certifications and covenants will be required from eligible borrowers. The lender is expected to collect the required certifications and covenants from each borrower at the time of origination or upsizing of the Nonprofit Main Street Loan, as applicable. Lenders may rely on a borrower’s certifications and covenants, as well as any subsequent self-reporting by the borrower.

1. The borrower will not repay principal or interest on any other debt (other than mandatory principal or interest payments that are due) until the Nonprofit Main Street Loan is fully repaid.

2. The borrower will not seek to cancel or reduce any of its committed lines of credit with the lender of the Nonprofit Main Street Loan or any other lender.

3. The borrower has a reasonable basis to believe that, as of the date of origination or upsizing, as applicable, and after giving effect to such loan, it has the ability to meet its financial obligations for at least the next 90 days and does not expect to file for bankruptcy during that time period.

4. The borrower will follow compensation restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act, i.e.,

a. Compensation restrictions:

i. For officers and employees whose total compensation exceeded $425,000 (but was less than $3 million) in 2019 or, if applicable, a subsequent reference period (as described below), borrowers may not, beginning the year of the loan and continuing for the one-year period following the satisfaction of the loan, pay such officer or employee during any 12 consecutive month period more compensation than that officer or employee received in 2019 or the subsequent reference period or pay severance/other benefits upon termination of employment with the borrower that exceed twice the maximum total compensation in 2019 or the subsequent reference period. These restrictions do not apply to any employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020. These restrictions continue to apply, however, to an employee whose compensation is determined pursuant to a pre-existing employment agreement or other written compensation arrangement.

ii. For officers and employees whose total compensation exceeded $3 million in 2019 or the subsequent reference period, borrowers may not, beginning the year of any loan and continuing for the one-year period following the satisfaction of the loan, pay such officer or employee during any consecutive 12 month period more than $3 million plus 50% of the amount over $3 million received by the officer in 2019 or the subsequent reference period or, except for an employee whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020, pay severance pay/other benefits upon termination of employment with the borrower that exceed twice the maximum total compensation in 2019 or the subsequent reference period.

In addition, certain restrictions apply to new hires and existing officers or employees who become highly compensated. Specifically, for an officer or employee whose employment with a borrower started during 2019 or later, the “subsequent reference period” is the 12-month period starting from the end of the month in which the individual began employment, if his or her total compensation exceeds $425,000 during such period. For an officer or employee whose total compensation first exceeds $425,000 during a 12-month period ending after 2019, the “subsequent reference period” is the 12-month period starting from the end of the month in which his or her total compensation first exceeded $425,000.

“Total compensation” includes salary, bonuses and other financial benefits provided by the borrower and its affiliates to an officer or employee of the borrower.

5. The borrower is eligible to participate in the Main Street Program, including by meeting all eligibility criteria described above and in light of the conflicts of interest prohibition in section 4019(b) of the CARES Act (“Conflicts of Interest Prohibition”)—i.e., Businesses in which the President, Vice President, an executive department head, Member of Congress—or such individual’s spouse, child (including adult children), son-in-law, or daughter-in-law (each a “covered individual”)—own, control or hold at least a 20% direct or indirect equity stake (by vote or value) of the outstanding amount of any class of equity interest will not be eligible for emergency relief funds under Title IV of the CARES Act, including Main Street Program funds.

Each borrower that participates in the Main Street Program should make commercially reasonable efforts to maintain its payroll and retain its employees during the term of the loan; however, no corresponding certification is required.

Lender Certifications and Covenants

In addition to other certifications required by applicable statutes and regulations, the following certifications and covenants will be required from lenders of Nonprofit Main Street loans:

- The lender will not request that the proceeds of the loan be used to repay debt extended by the lender to the borrower, or any interest (other than mandatory principal or interest payments, or in the case of default or acceleration) until the Main Street loan is fully repaid.

- The lender will not cancel or reduce any existing committed lines of credit outstanding to the borrower, other than in an event of default.

- The methodology required to be used by the borrower for calculating the borrower’s adjusted 2019 EBIDA and operating is the methodology it has previously used when extending credit to the borrower or similarly situated borrowers (or originating or amending the underlying facility, in the case of an Nonprofit Expanded Loan) on or before June 15, 2020.

- The lender is eligible to participate in the Main Street Program, including in light of the Conflicts of Interest Prohibition.

Main Street Lenders

Eligible lenders under the Main Street Program are US insured depository institutions, US bank holding companies, and US savings and loan holding companies.

Lenders of Nonprofit Main Street Loans will be required to retain (until the earlier of maturity or until the Nonprofit Main Street Program sells all of its 95% participation), with respect to both types of Nonprofit Main Street Loans, a 5 percent share of such loan, and the Fed will purchase at par value a 95% participation in the applicable loan to the Nonprofit Main Street Program. The Nonprofit Main Street Program and the applicable lenders would share in any losses on the Main Street loans on a pari passu basis. For a Nonprofit Expanded Loan, the lender must be one of the lenders that holds an interest in the underlying loan at the date of the upsizing. Additionally, the lender must retain its interest in the underlying loan until the earlier of the underlying loan’s maturity, the Nonprofit Expanded Loan’s maturity or the date the SPV sells all of its 95% participation.

The Main Street Program will pay eligible lenders 0.25% of the principal amount of the participation in eligible Nonprofit Main Street Loans per annum for loan servicing.

Lenders are expected to conduct an assessment of each potential borrower’s financial condition at the time of the potential borrower’s application.

The sale of a participation interest in either of the two loans will be structured to be a true sale, and must be completed expeditiously after the loan’s origination or upsizing, as applicable.

Disclosure and Reports

The Fed will disclose information regarding the Nonprofit Main Street Loans during the operation of the Main Street Program, including information regarding names of lenders and borrowers, amounts borrowed and interest rates charged, and overall costs, revenues and other fees. Under section 11(s) of the Federal Reserve Act, the Fed also will disclose information concerning the Main Street Program one year after the effective date of the termination of the authorization of the Main Street Program. This disclosure will include names and identifying details of each participant in the Main Street Program, the amount borrowed, the interest rate or discount paid, and information concerning the types and amounts of collateral pledged or assets transferred in connection with participation in the Main Street Program.

The Fed also will provide periodic reports on the size of the Main Street Program and its remaining capacity.

Updates regarding Nonprofit Main Street Loans will be made available on the Fed’s website.

Changes to Main Street Program and Terms

The Board of Governors of the Federal Reserve System and the Secretary of the Treasury may make adjustments to the terms and conditions of the Main Street Program and will announce any changes on the Fed’s website.

Before applying for any Main Street loan, borrowers should review existing credit agreements, governing documents and other contracts to identify any restrictions on the incurrence of additional indebtedness, including any required consents.

Seyfarth is actively monitoring all aspects of federal COVID-19 business stimulus funding legislation and guidance impacting our clients. Visit our Resource Center for more information.

[1] The methodology used by the lender to calculate adjusted 2019 EBIDA must be the methodology it has previously used for adjusting EBIDA when extending credit to the borrower or similarly situated borrowers on or before June 15, 2020. The lender should calculate operating revenue as unrestricted operating revenue, excluding funds committed to be spent on capital, and including a proxy for endowment income in place of unrestricted investment gains or losses. The methodology used by the lender to calculate the proxy for endowment income must be the methodology it has used for the borrower or similarly situated borrowers on or before June 15, 2020.

[2] For purposes of this requirement, “liquid assets” is defined as unrestricted cash and investments that can be accessed and monetized within 30 days.

[3] For purposes of this requirement, “non-donation revenues” equal gross revenues minus donations; “donations”, “donations” include proceeds from fundraising events, federated campaigns, gifts, and funds from similar sources, but exclude government grants, revenues from a supporting organization, grants from private foundations that are disbursed over the course of more than one calendar year, and any contributions of property other than money, stocks, bonds, and other securities (noncash contributions), provided that such noncash contribution is not sold by the organization in a transaction unrelated to the organization’s tax-exempt purpose, and “expenses” equal total expenses minus depreciation, depletion, and amortization.

[4] As firms cannot rely on LIBOR being published after the end of 2021, consistent with the recommendations of the Alternative Reference Rates Committee, the Fed has advised that Main Street Program lenders and borrowers should include fallback contract language to be used should LIBOR become unavailable during the term of the loan.

Seyfarth Shaw LLP provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from their professional advisers.