Legal Update

Jun 17, 2019

Governor Signs Legislation Amending Massachusetts Paid Family And Medical Leave Law And DFML Extends Worker Notice And Private Plan Application Deadlines And Announces Updated Contribution Rates

Seyfarth Synopsis: On June 13, 2019, Governor Baker signed into law S 2255, officially delaying the start of the payroll deductions for the Massachusetts Paid Family and Medical Leave (PFML) program by three months to October 1, 2019 and implementing other technical changes. On June 14, 2019, in response to the three-month delay, the Department of Family and Medical Leave (DFML) extended the deadline for distributing the mandatory PFML notice to workers from June 30th to September 30, 2019 and the deadline for applying for a private plan exemption to December 20, 2019. Now, employers will remit the required contributions for the October - December quarter by January 31, 2020. The DFML also has provided an updated breakdown of the new 0.75% contribution rate.

Deadline Extensions And New Contribution Rates

In response to the three-month delay of the payroll deductions and contributions, the DFML extended a number of the program’s other deadlines. Rather than racing to finalize and distribute the mandatory worker notice by June 30, employers will now have until September 30 to provide the mandatory notice to all Massachusetts covered workers. The DFML announced that it will be revising and posting on its website updated template notices in the coming days.

For employers considering applying for a private plan exemption, the application deadline has been extended from September 20 to December 20, 2019.

The date for the first payment of the employer-worker contributions to the public program’s trust fund has changed from October 31, 2019 to January 31, 2020, covering the first quarter, October 1 to December 31.

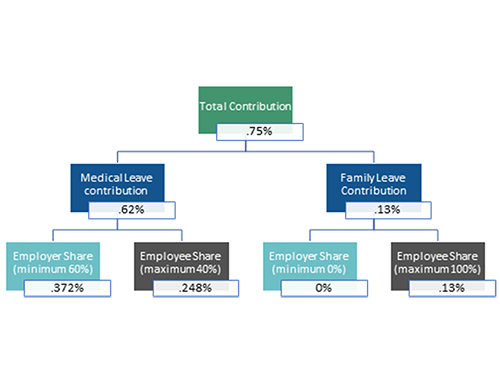

To make up for the loss of three months’ worth of contributions, the DFML announced that the contribution rate will increase from 0.63% to 0.75%. The new contribution rate will be allocated as 0.13% for family leave and 0.62% for medical leave. If charging employees the 40% maximum share of the 0.62% medical leave contribution, the employee share will be 0.248% and the employer share will be 0.372%. Employers may also charge employees 100% of the 0.13% family leave contribution. The DFML has provided the following chart to explain the breakdown of the new contribution rate as well as the obligation for employers with 25 or more covered workers.

According to the DFML, the final PFML regulations will be posted to the DFML website on Monday, June 17, 2019, and they will go into effect on July 1, 2019.

Technical Amendments To PFML Law

The technical amendments made the following changes and/or clarifications to the PFML Law:

- The term “serious health condition” will have the same meaning under the PFML as under the federal Family Leave and Medical Leave Act.

- A covered individual who is a former employee shall be eligible for PFML benefits if he or she is unable to perform the functions of their most recent position or other suitable employment as that term is defined under the unemployment benefits statute, subsection (c) of section 25 of Chapter 151A.

- Previously, the provision related to the taking of leave intermittently or on a reduced leave schedule stated that taking such leave would “not result in a reduction in the total amount of leave to which the covered individual is entitled.” The amendment clarifies that the total amount of leave will in fact be reduced based on the amount of leave actually taken.

- The amendments clarify that a health care provider should include the following information in the certification for a covered individual taking medical leave: a statement by the health care provider that the covered individual is unable to perform the functions of the covered individual’s position, a statement of the medical necessity, if any, for intermittent leave or leave on a reduced leave schedule and, if applicable, the expected duration of the intermittent leave or reduced leave schedule.

- The certification for a covered individual taking family leave of because of the serious health condition of a family member may also be required to provide a statement of the medical necessity, if any, for intermittent leave or leave on a reduced leave schedule and the expected duration of the intermittent leave or reduced leave schedule. The same changes were made to the provision for covered individuals taking family leave to care for a family member who is a covered service member.

- Previously, the PFML Law assessed employers or covered business entities who failed or refused to make the required contributions a penalty of 0.63% of its total annual payroll for each year or fraction of a year that is failed to comply as well as the total amount of benefits paid to covered individuals for whom it failed to make contributions. The amendment changes this penalty to an amount equal to the employer’s or covered business entity’s total annual payroll for each year, or the fraction thereof for which it failed to comply, multiplied by the then-current annual contribution rate required in addition to the total amounts of benefits paid to covered individuals for whom it failed to make contributions. This change accounts for potential increases in the contribution rate, including the most recent increase to 0.75%.

The Associated Industries of Massachusetts (AIM) was a key player in convincing State Leaders to amend the PFML Law and extend the various key dates and deadlines.

For our prior reports on the PFML Law and the proposed regulations, you may refer here.